cumulative preferred stockholders have the right to receive

Preferred stock combines aspects of. They differ mainly in that warrants are.

Equity is money currently held by your company.

. Any corporation may by resolution of its board of directors determine that only a part of the consideration which shall be received by the corporation for any of the shares of its capital stock which it shall issue from time to time shall be capital. Dividend yield ratio Dividend Yield Ratio Dividend yield ratio is the ratio of a companys current dividend to its current share price. 2500 shares issued and outstanding.

The shareholders equ accounts with balances as of Jan. But in case any of the shares issued shall be shares having a par value the amount of the part of such consideration so determined to be. Non-Cumulative Preference Shares Refer to the shares for which dividends are not accumulated over a period of time.

During 20X4 and thereafter the stated dividend of 8 measured against the carrying amount of 100 18 would reflect dividend cost of 8 the market rate at time of issuance. When the organization has sufficient profit the accumulated dividend of these preference shares is paid. Stockholders acts can bind the corporation even though the stockholders have not been appointed as agents of the.

Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. Preferred Dividend Yield Calculation. It shows what belongs to the business owners and the book value of their investments like common stock preferred stock or bonds.

Convertible preferred stock is preferred stock that includes an option for the holder to convert the preferred shares into a fixed number of common shares usually any time after a predetermined. For one thing companies get a tax write-off on the dividend income of preferred stocks. As of June 30 2020 the aggregate market value of shares held by non-affiliates of the registrant based upon the closing sale prices of such shares on the Nasdaq Global Select Market on June 30 2020 was approximately 8497 billion.

Both are discretionary and have expiration dates. Common shareholders have no guarantee that they will receive dividends. 1 2018 are as follows.

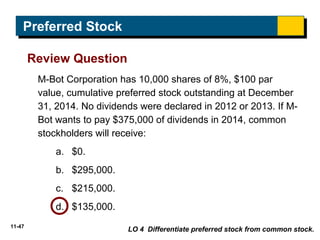

In finance a warrant is a security that entitles the holder to buy or sell stock typically the stock of the issuing company at a fixed price called the exercise price. Cumulative preferred stockholders have a right to be paid both the current and all prior periods. However if the earnings of a company increase the company may choose to raise the dividends that it pays on common stock.

Preferred stockholders enjoy priority in receiving such dividends compared to common stock which means the company must first discharge the liability of preferred dividends before discharging any liability of dividends payable to the preferred stockholders. For example if a company owns 20 or more of another distributing companys stock they dont have to pay taxes on the first 65 of income received from dividends. Preferred stock holders receive a fixed guaranteed dividend payment.

On November 2 2003 Finsbury Inc. Companies also use preferred stocks to transfer corporate ownership to another company. Cumulative Preference Shares Refer to the shares for which dividends get accumulated over a period of time.

There are 40000 shares of preferred stock outstanding at a market price of 34 a share. The staff believes that existing authoritative literature while not explicitly addressing increasing rate preferred stocks implicitly calls for the accounting described in this bulletin. Ordinary Shares P25 stated value 100000 shares authorized 50000 shares issued Share Premium Appropriation for Plant Expansion Appropriation for Treasury Stock Retained Earnings P1250000 250000 150000 80000 725000 Treasury.

Preferred stock is a special type of stock that pays a set schedule of dividends and does not come with voting rights. The right to receive a minimum amount of dividends. For purposes of calculating the aggregate market value of shares held by non-affiliates we have assumed that all outstanding.

The stockholders equity is also sometimes referred to as owners equity. Which of the following is not a right possessed by common stockholders of a corporation. The bond issue has a tot al face value of 500000 and sells.

Investors who buy a corporations stock sometimes receive a stock_____ as proof of share ownership. Read more 560 100 833 Yield is the effective interest rate Effective Interest Rate Effective Interest Rate also called Annual Equivalent Rate. The stockholders equity often referred to as the book value of the company is the number of assets available to the stockholder after its entire liabilities is paid off.

5 cumulative preferred stock par value 100 per share. Take obtain receive subscribe for own use dispose of sell exchange lease lend assign mortgage pledge or otherwise acquire transfer or deal in or with bonds or obligations of or shares securities or interests in or issued by any person. Evofem Biosciences to Participate in Piper Sandler 33rd Annual Healthcare Conference.

Hoyt Corps current balance sheet reports the following stockholders equity. Evofem Biosciences to Adjourn Special Meeting of Stockholders on December 8 2021. It represents the potential return on investment for a given stock.

When stock is cumulative preferred stock and the board of directors does NOT delcare a dividend the unpaid dividend amount is called. Evofem Biosciences Successfully Extends Cumulative Net Sales Covenant Timing to June 30 2023. Preference shares more commonly referred to as preferred stock are shares of a companys stock with dividends that are paid out to shareholders before.

Issued warrants to its stockholders giving them the right to purchase additional 20 par value common shares at a price of 30. Preferred Dividends are fixed dividends received from Preferred stocks Preferred Stocks. This category is usually called owners equity for sole proprietorships and stockholders equity or shareholders equity for corporations.

Meanwhile the preferred stockholders plug along still getting the same fixed rate. The right to vote in the election of the board of directors b. NRS 78257 Right of stockholders to inspect copy and audit financial records.

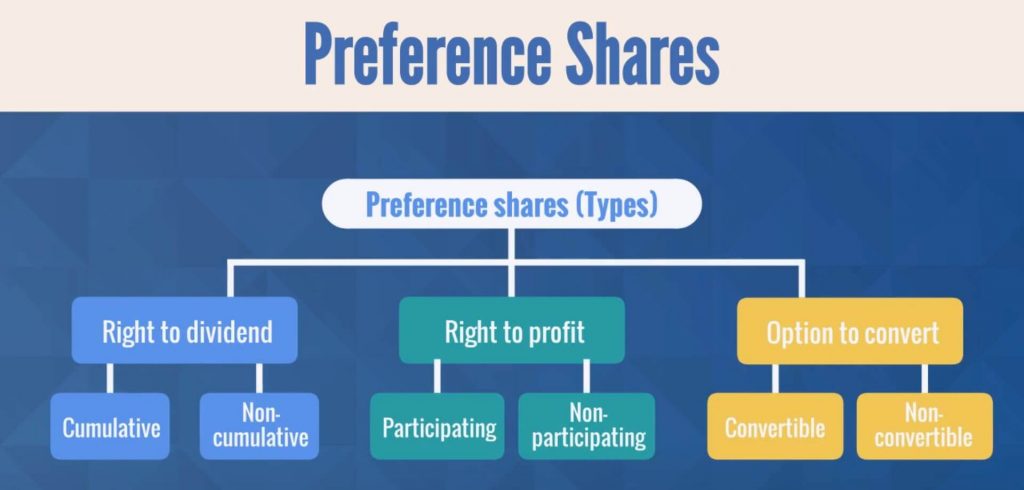

Get To Know About Sub Categories Of Preference Shares Articles Of Association Preferences Share Market

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

Iso 9001 Management Tips Productivity Increase Income

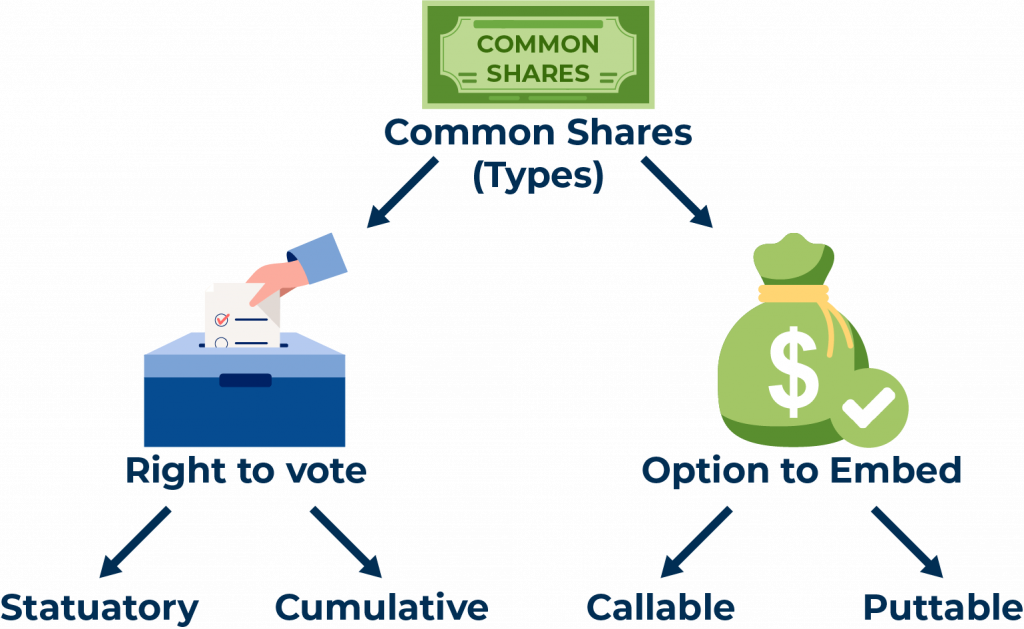

Common Stock Vs Preferred Stock 365 Financial Analyst

Learn About Shareholders Rights Preferred Stock Preferred Shares Chegg Com

Common Stock Vs Preferred Stock 365 Financial Analyst

Cumulative Preferred Stock Definition

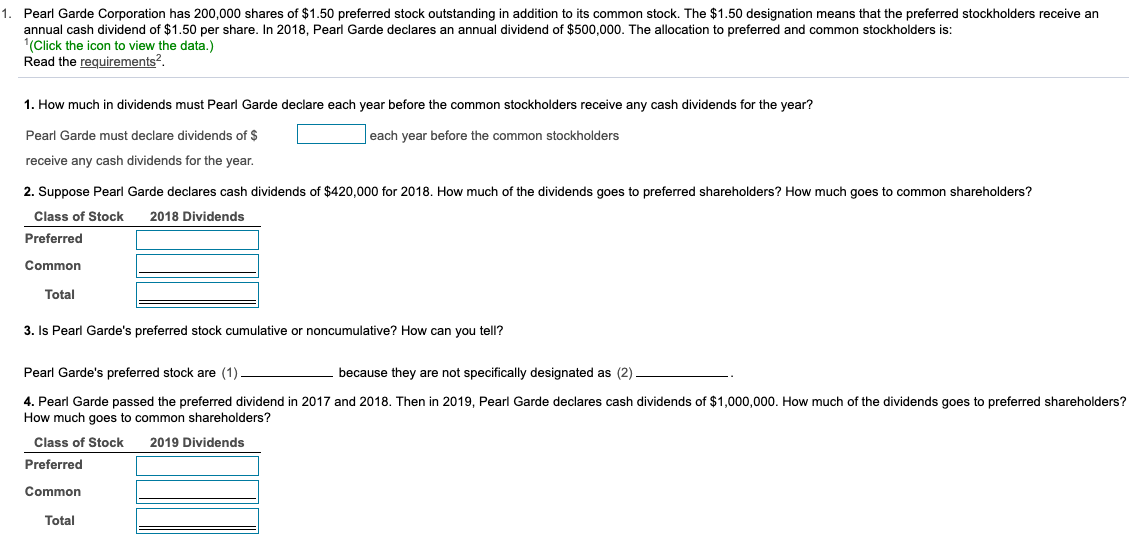

Solved 1 Pearl Garde Corporation Has 200 000 Shares Of Chegg Com

Difference Between Cumulative And Non Cumulative Preferred Stocks Ask Any Difference

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

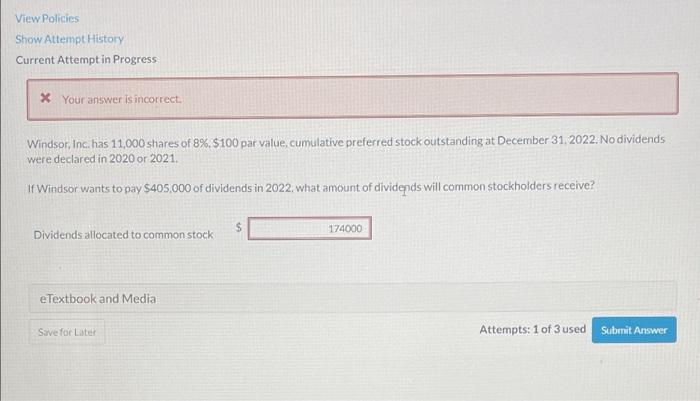

Solved View Policies Show Attempt History Current Attempt In Chegg Com

Acc102 Chap11 Publisher Power Point

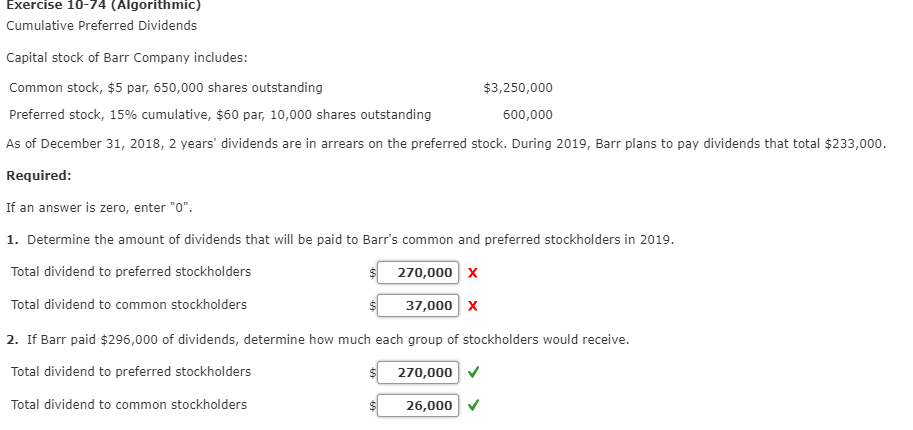

Solved Exercise 10 74 Algorithmic Cumulative Preferred Chegg Com

Common And Preferred Stock Principlesofaccounting Com

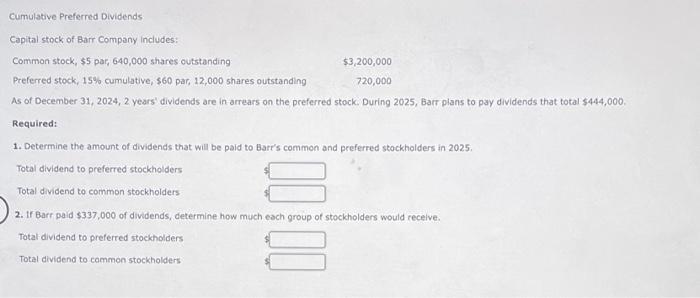

Solved Cumulative Preferred Dividends Capital Stock Of Barr Chegg Com

/PreferredStock-FINAL-c6dbf29d50d34121aa17f0b7ea771bad.png)